US Electrical Automotive Market on the Whim of Tesla Provide-vs-Demand Developments

[ad_1]

Join every day information updates from CleanTechnica on electronic mail. Or observe us on Google Information!

A few days in the past, I wrote a few considerably difficult state of affairs within the used electrical automobile market. I included a number of notes for issues affecting used EV costs and time on lot. Nonetheless, a number of the particulars additional, I wished to revisit this and spotlight an important level for the market now and going ahead: the used electrical automobile market within the US is, even broadly talking, on the whim of Tesla’s supply-vs-demand traits.

Beginning with the matter of worth, in 2022, many Tesla homeowners have been promoting or buying and selling of their Teslas as a result of that they had retained a lot worth or had in some instances even risen in worth. The difficulty was that because of the wackiness of COVID-19, financial lockdowns, provide chain challenges, stimulus funds, and related issues, demand for vehicles (new and previous) had skyrocketed on the identical time that provides have been crunched, and this led to excessive automobile costs. Given the stage of Tesla’s progress at that time, this notably affected Tesla autos. I recall a number of Tesla homeowners promoting or buying and selling of their vehicles on the time and bragging about how a lot cash they obtained for them. Tesla was in no way the one firm influenced by these issues, however its swing was accentuated.

As these points labored themselves out and the market obtained again to one thing extra “regular,” Tesla ramped up manufacturing globally and set gross sales report after gross sales report quarter after quarter. That led to: ramp manufacturing, ramp manufacturing, ramp manufacturing. However … as we all know, Tesla reduce costs significantly in current months. Clearly, manufacturing caught up with demand after which surpassed it at earlier costs. Which led to Tesla reducing costs, after which reducing them extra. After which we get this:

Common used EV costs within the US (most notably, common Tesla costs, which account for almost all of US EV gross sales) have been actually excessive in October 2022, after which have been down significantly in October 2023. Taking a look at what was taking place with Tesla, this comes as no shock. Add in the truth that new Tesla autos now get a $7,500 tax credit score! (That knocks hundreds of {dollars} off of the worth of a used Tesla by default.)

There’s yet another factor to take a look at as nicely. When Tesla’s costs drop sharply and unexpectedly, you already know that has to have an effect on different electrical vehicles in the marketplace. That drags down costs individuals are prepared to pay for different, competing electrical autos. However, how shortly are the sellers of these different used EVs truly going to reply? They received’t reply in a single day. The end result: a whole lot of used EVs sitting on the lot for longer than regular.

Curiously, with used Tesla costs depressed first and most immediately by the worth cuts to new Teslas, Tesla’s autos have been transferring off of the lot barely faster than the nationwide common.

As we are able to see, huge fluctuations in Tesla provide & demand don’t simply have an effect on Tesla. They’ve a notable impact on the costs and motion of competing electrical autos. We are able to’t make broad statements concerning the used electrical automobile market with out taking into consideration that Tesla dominates the US electrical automobile market, and massive adjustments at Tesla will inherently imply huge adjustments throughout the market.

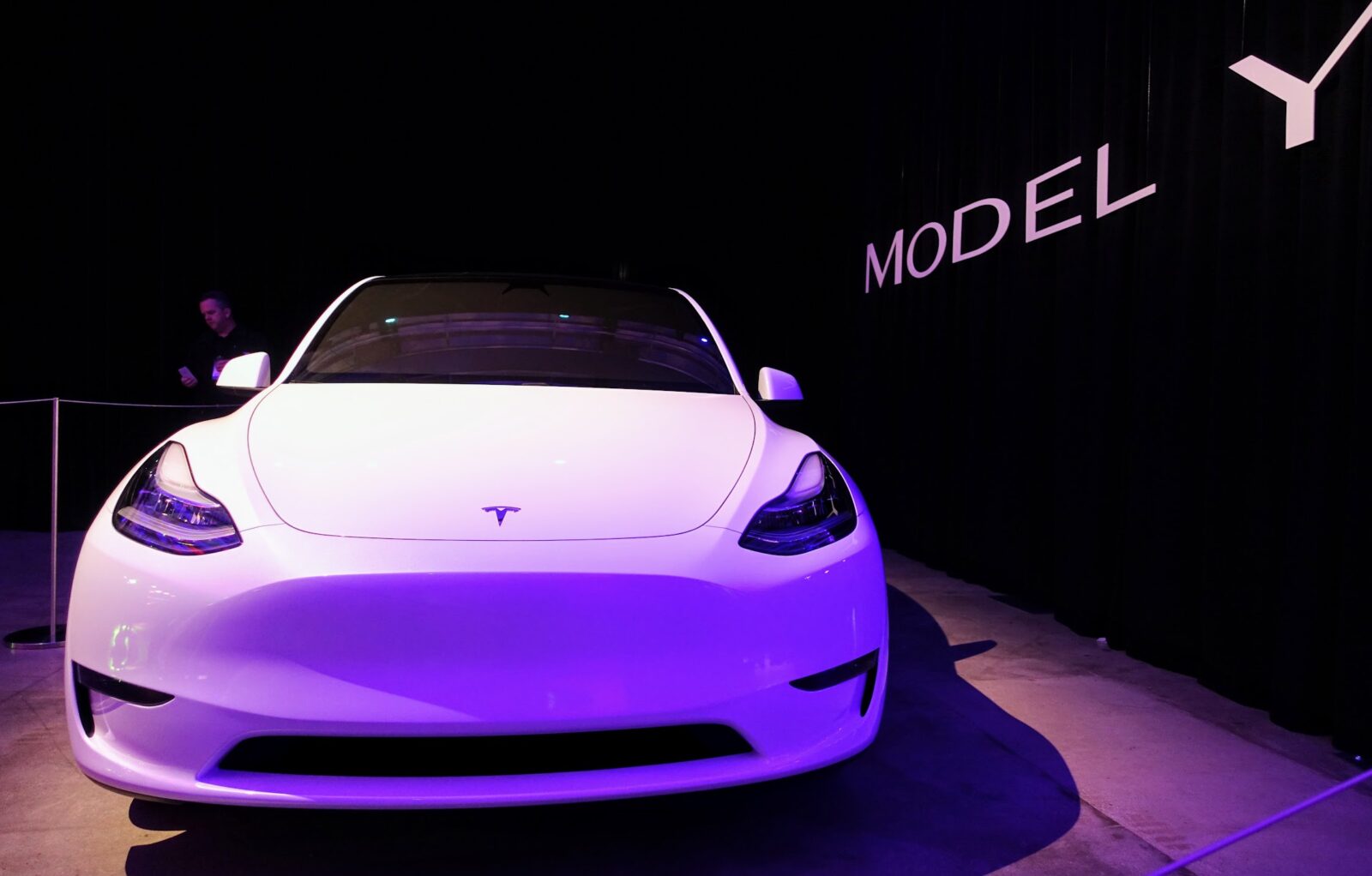

With all of that in thoughts, what’s going to 2024 carry? Are we going to see any sudden or dramatic adjustments in Tesla costs and availability? I don’t assume so. I don’t see demand taking pictures up nicely above manufacturing capability, and I don’t assume Tesla can decrease costs far more because it has already considerably reduce into gross margins with a purpose to transfer product. Although, it’s notable that the Lengthy Vary and Commonplace Vary Mannequin 3 can be dropping entry to the $7,500 US EV tax credit score (because of too their batteries coming from China, a problem Tesla apparently hasn’t been in a position to remedy prior to now 12 months). As such, I feel there may very well be a bit additional strain on Tesla costs and thus different electrical automobile costs. However — that can most likely additionally imply extra Tesla consumers deciding to go for the Mannequin Y as an alternative of the Mannequin 3. Shifting important volumes of Mannequin 3 demand to the Mannequin Y might put a manufacturing bottleneck on the Y relative to demand, probably resulting in notable worth will increase. If this occurs, different electrical crossovers might additionally get worth will increase or see their wheels roll off of seller tons and into buyer driveways faster. So, once more, there are methods the remainder of the US electrical automobile market, together with used electrical automobile market, may very well be considerably influenced by adjustments in Tesla demand vs. provide. We’ll see what comes about in 2024.

What do you consider coming adjustments to Tesla demand, pricing, and gross sales within the US — and, equally, adjustments to the remainder of the US EV market?

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Discuss podcast? Contact us right here.

Our Newest EVObsession Video

https://www.youtube.com/watch?v=videoseries

I do not like paywalls. You do not like paywalls. Who likes paywalls? Right here at CleanTechnica, we carried out a restricted paywall for some time, but it surely all the time felt fallacious — and it was all the time powerful to resolve what we should always put behind there. In concept, your most unique and finest content material goes behind a paywall. However then fewer folks learn it!! So, we have determined to fully nix paywalls right here at CleanTechnica. However…

Thanks!

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

[ad_2]

Supply hyperlink

Leave a Reply