When Will New Automotive Costs Drop?

[ad_1]

Fast Details About Automotive Costs

- In November 2023, common new automotive transactions had been about 23% larger than the identical month three years in the past when no finish was in sight for the pandemic.

- Nonetheless, common transaction costs are flat in contrast with final yr.

- Producer incentives averaged about $2,500 in November. Incentives are up 136% from this time final yr.

- You may simply discover a new Jeep, Infiniti, Ram, or Volvo, although not essentially a Toyota, Honda, Lexus, or Kia.

Within the final a number of years, automotive consumers have grown accustomed to paying greater than the producer’s advised retail worth (MSRP). They watched automotive costs steadily rise, without end. It left many consumers scratching their heads, and the query our consultants get most is, “When will new automotive costs drop?”

We will let you know that new automobile worth inflation has virtually disappeared this yr. That’s nice information on its face. Nonetheless, automotive costs have elevated exponentially within the final three years. Now, the current United Auto Staff strike threatens stock and prices once more.

On this story, we’ll clarify how one can navigate automotive shopping for in order that for those who’re available in the market to buy a automobile, you’ll be outfitted with the perfect data from our consultants. We dig deeper to reply considerations about automotive costs dropping.

What Drives New Automotive Costs?

In keeping with Kelley Blue E book knowledge, new automotive common transaction costs (ATP) stayed flat month-over-month in November at $48,247. In keeping with Cox Automotive analysts, new automobile transaction costs fell greater than 1.5% year-over-year as downward worth stress continues to favor patrons available in the market.

“Whereas customers might really feel some reduction in automobile costs and incentives as we shut out 2023, automakers and sellers are feeling the outcomes of the downward worth stress,” stated Rebecca Rydzewski, analysis supervisor at Cox Automotive, the father or mother firm of Kelley Blue E book. “The newest seller sentiment survey by Cox Automotive clearly signifies that sellers are seeing income contract as stock ranges return to regular, and incentives are turned as much as assist stimulate gross sales.”

Producer incentives elevated to a median of $2,500 in November, up 136% from a yr in the past. Extra on that in a bit.

Common transaction costs stay about 23% larger than in November 2020 because the realities of the COVID-19 pandemic appeared endless. At the moment, common transaction costs for brand spanking new autos had been $39,259.

Car Pricing Breakdown

- Non-luxury automobile costs: In November, automotive patrons paid a median transaction worth of $44,417. General, costs have held regular since January.

- Luxurious automobile costs: The common transaction worth was $63,235 for luxurious autos. Luxurious autos make up about 20% of whole automobile gross sales. Luxurious costs dropped by almost 7.5% year-over-year.

- Electrical automobile costs: The common transaction for a brand new electrical automotive is $52,345, down from about $65,000 a yr in the past. Tesla common transaction costs dropped almost 21% in comparison with November 2022.

“In current months, worth parity between EVs and ICE has virtually appeared attainable,” stated Stephanie Valdez-Streaty, director of strategic planning at Cox Automotive. “It’s a sophisticated measure with loads of variables, however newer merchandise and better reductions have introduced down common EV costs, even earlier than potential tax incentives. A yr in the past, the EV premium was greater than 30%. Right now, it’s lower than 10%.”

These elements usually have an effect on new automotive costs:

- Stock availability

- Producer incentives

- Vendor reductions

- Commerce-in automobile worth

All 4 of these elements skilled main disruptions previously a number of years.

New Automotive Stock Replace

Dealerships measure their shares of latest automobiles to promote in a measurement referred to as “days of stock” — how lengthy it could take them to promote out of latest autos at in the present day’s gross sales tempo if the automaker stopped constructing new ones. Final yr, inventories fell to only one week. By the beginning of December, many manufacturers’ inventories had been up 57% from a yr in the past. That’s the very best stock stage since early spring 2021. Nonetheless, just a few carmakers, like Toyota, Honda, Lexus, and Kia, can’t fill all automotive orders because of a scarcity of stock. Days’ provide calculations embrace autos in seller stock and in transit or pipeline.

Earlier than the United Auto Staff strike in September, home automotive manufacturers started including extra autos to stock. In contrast, stock fell to file lows through the peak of the pandemic and worldwide microchip scarcity. With out sufficient essential microchips, which management every little thing from engine timing to navigation programs, automakers couldn’t construct automobiles as quick as they needed. Regardless of near-normal automotive stock for many carmakers, the lingering results of provide chain points and the chip scarcity proceed for some carmakers and specific fashions.

In 2022, producers like Ford started rethinking inventories for the lengthy haul regardless of the resolving chip scarcity.

Which Automakers Have the Most Autos?

Cox Automotive’s evaluation of its vAuto new and used automotive dealership administration software program knowledge reveals that manufacturers like Lincoln, Chrysler, Jaguar, Alfa Romeo, Dodge, and Fiat provide days’ provide that’s effectively above twice the trade common. In distinction, stock ranges nonetheless sit effectively underneath regular for Toyota, Honda, Lexus, Kia, Land Rover, and Subaru.

RELATED: Is Now the Time to Purchase, Promote, or Commerce-In a Automotive?

General, the auto trade stocked 71 days’ price of autos in the beginning of December. That’s thought of a standard provide of stock by historic requirements, and it’s additionally the very best since early spring 2021. By comparability, automakers stocked a wholesome 86-day provide of autos through the summer season of 2019 earlier than the pandemic.

Car Incentives Maintain Regular

Carmakers used extra incentives to draw patrons than at any level previously two years. In November, they remained unchanged. In keeping with Kelley Blue E book’s analysts, carmakers spent 5.2% of the typical transaction worth on incentives meant to maneuver autos. Incentives averaged about $2,500. Nonetheless, these are thought of traditionally low in comparison with fall 2020, when incentives had been about 20% of the typical transaction worth.

When automakers construct up an oversupply of automobiles, they low cost the autos to get them off seller tons. For the previous a number of years, carmakers and dealerships confirmed no glut of automobiles to promote, they usually barely discounted. Now, provide is bulking up once more, partly due to larger rates of interest on automotive loans.

In keeping with our evaluation, the luxurious automotive section provided the most important incentives by way of a lot of 2023. In November, luxurious model incentives reached 5.8% in contrast with non-luxury incentives at 5%.

Store Round for the Finest Supply on Your Commerce-In

Commerce-in worth is one other issue driving automotive costs. A scarcity of used automobile inventory is pushing costs larger, giving inventory to the concept that shopping for a brand new automobile is cheaper than buying a more moderen mannequin used one. In that vein, it’s a good time to commerce in your automobile. Automakers scaled again manufacturing for a number of years after the 2008 recession. That leaves the higher-mileage, older automobiles sellers promote for lower than $20,000 significantly exhausting to search out now.

Sellers worth your trade-in partly based mostly on what they want in inventory. They’re extra more likely to provide a superb deal to patrons on a automotive fewer persons are on the lookout for at the moment. Automotive sellers are oversupplied with comparatively costly used automobiles.

In different phrases, customers buying and selling in a 2018 Honda Civic shall be a lot happier with the commerce appraisal than these buying and selling in a 2021 Jeep Grand Cherokee.

Consumers must also be ready to store their trade-in round. It’s barely extra sophisticated to tug off, however promoting your previous automotive to at least one dealership might make sense, and shopping for your new automotive from a distinct one if the ultimate bill numbers work out higher. Use the Kelley Blue E book On the spot Money Supply instrument to buy your trade-in automobile at close by dealerships. While you let the offers come to you, you possibly can choose the perfect trade-in provide on your scenario.

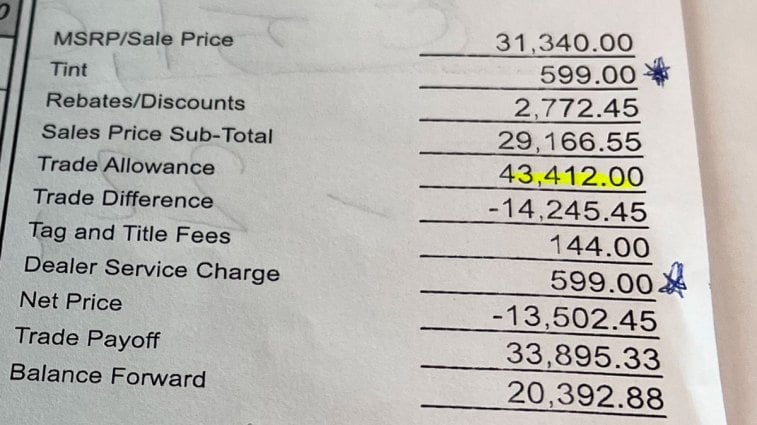

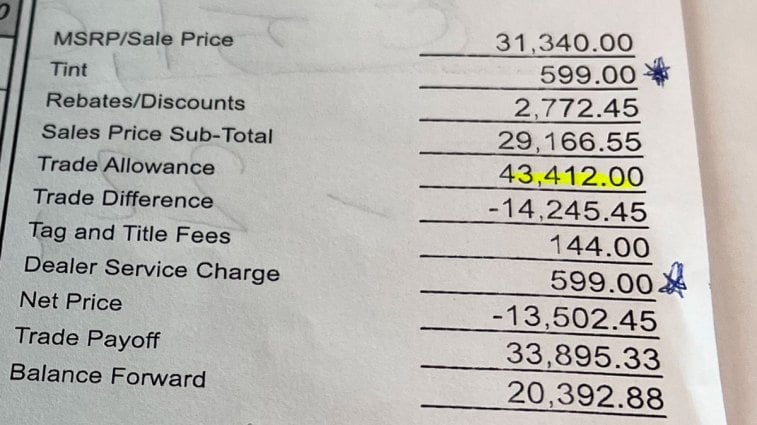

PRO TIP: I lately used the On the spot Money Supply instrument to see what I may get for a household automobile whereas sitting in a dealership attempting to seal a deal for a subcompact SUV. The presents began flowing in as excessive as $50,000 for our 2021 Ford F-150 Lariat with a hybrid powertrain with low miles of 13,000 and no accident historical past. On the dealership the place I used to be making an attempt to make the deal, they provided $43,412. With a Kelley Blue E book worth of $50,196, I attempted to make use of the opposite presents as leverage, however the dealership wouldn’t budge. So, I walked away from the dealership with the low-ball provide and went to a different with the perfect provide.

New Automotive Costs Proceed to Drop

So, when will new automotive costs go approach down? For some manufacturers and a few dealerships, costs started dropping. With different manufacturers, like Toyota, Honda, and Kia, consumers should be ready to hunt and pay extra for tougher-to-find fashions. In current months, hard-to-find automobiles and SUVs embrace the brand new Toyota Grand Highlander, Honda CR-V and its hybrid model, Toyota Camry, Toyota Corolla, Honda Civic, and Toyota RAV4.

Some Autos Nonetheless Promote at Markup Costs

Whereas some carmakers and sellers with loads of stock present incentives, others are nonetheless briefly provide. It means some dealerships are nonetheless marking up choose autos.

In keeping with Markups.org, some Honda, Toyota, Ford, and Kia fashions promote above MSRP in locations like California, Florida, and Texas. In Georgia, a Hyundai Tucson was marked up at a dealership within the Atlanta space.

PRO TIP: Since buying lately for a automobile, I discovered markups different at dealerships that offered autos equivalent to Kia and Hyundai. One seller charged $599, and one other $699. One other referred to as them “doc charges.” Earlier than you store, perceive how a lot these doc submitting charges price for automotive tax, tag, and title in your state before you purchase a automobile. These are pure markups or revenue facilities for the dealership. One other markup on an bill might say “paint and cloth safety” or “window tint.” Earlier than you signal something, it’s sensible to ask the salesperson to take away these charges in the event that they actually wish to promote you the automotive.

What to Count on: Trying Forward

However what for those who desperately desire a common automotive that’s in low provide? Then, it’s time to check your endurance. Federal Reserve rate of interest hikes used earlier this yr to rein in inflation nonetheless make it tougher for customers to purchase automobiles. In keeping with Cox Automotive analysis, the everyday new automotive mortgage rate of interest declined in December to a median of 9.6%. That’s down from about 10% in October. Meaning automobile affordability is bettering, even when slowly. Moreover, cooling inflation leaves the door open for rate of interest cuts within the close to future.

For now, automotive consumers should stay versatile. Discovering a low worth on a brand new automotive is feasible. It simply might not be the automotive you thought you’d purchase. Or chances are you’ll want to move to a smaller city exterior the large metropolis the place there’s much less competitors.

Editor’s Word: This text has been up to date for accuracy because it was initially printed. Sean Tucker contributed to this report.

Associated Articles for Automotive Shopping for:

[ad_2]

Supply hyperlink

Leave a Reply