Electrical automobiles with recycled batteries are the subsequent inexperienced Holy Grail

[ad_1]

They name themselves “rubbish collectors,” however the steel containers that Li and his staff in southern China collect and promote are in actuality immensely useful — and tough to return by.

The seven males are merchants of a scorching new commodity on this planet’s largest and most mature electric-vehicle market: used batteries. Each comprises prized components like lithium, cobalt and nickel that may be extracted and resold. With thousands and thousands of EVs now able to be discarded, and hundreds already deserted in graveyards throughout the nation, there’s a flood of retired batteries ready to be recycled.

All these valuable metals, hidden in junkyards, parking tons and driveways throughout China, are an important useful resource as international competitors for essential minerals escalates and international locations jostle to return out on high within the inexperienced transition. An efficient, secure and environmentally pleasant system for amassing and processing batteries would put Chinese language carmakers forward of the curve. They’d be capable of produce electrical automobiles with recycled batteries at scale — making them doubly inexperienced — giving them an edge over worldwide rivals as governments mandate extra EV gross sales and locations like Europe require minimal ranges of recycled metals in autos.

Reaching that time nonetheless would require consolidating a sprawling business of hundreds gamers — from freelancers like Li and different small unofficial recycling workshops to massive battery makers. Li, 29, is a part of a grey market that’s emerged alongside a fast-growing battery recycling business looking for to revenue from China’s first wave of EV decommissioning. He requested to solely use his final identify as a result of he operates exterior of the federal government system arrange for processing used batteries.

Coverage makers are beginning to put rules in place however, proper now, there’s nonetheless loads of cash to be made past the confines of official guidelines. “It’s identical to a wild fish pond with out anyone taking good care of it,” Li stated. “Whoever is aware of the place the pond is will get the fish.”

Recycling has at all times been a chaotic enterprise. From plastics to quick trend, amassing, transporting and processing waste requires coordination between a number of corporations that aren’t at all times incentivized to work collectively.

The identical points plague China, the place one in each three new autos offered is electrical, in contrast with one in eight in Europe. Officers say the nation could attain its aim of getting electrical automobiles account for 50% of all new gross sales by 2026 — 10 years forward of schedule. Based on the consultancy Round Power Storage, China can have practically 4 instances as many batteries to recycle by 2030 than it did in 2021 and the nation dominates in relation to preprocessing and supplies restoration. Some market analysis suggests an EV battery might final round 5 to eight years, though some say longer.

However China’s battery recycling regulation continues to be nascent. It’s generally convoluted for battery producers and automakers to retrieve expired cells, many automotive house owners do not know they’ll receives a commission for his or her used batteries, and recycling corporations have struggled to safe a dependable stream of outdated ones.

That’s the place merchants like Li step in. The 29-year-old posts ads on social media platforms equivalent to Douyin, a TikTok-like video platform, and leverages family and friends to seek out potential sellers. A battery might present up in a faraway province, so he’ll generally prepare for a courier from a ride-hailing service to choose it up, or journey to a different metropolis himself.

From there, the battery might go to a intermediary, an unlicensed workshop to be damaged down, or to an official recycler. Transactions are at all times executed rapidly and in money as a result of uncooked materials costs are so risky that recycling charges can change in as little as half a day.

Yang Lin, secretary normal of the battery recycling committee arrange below China’s Digital Power Saving Expertise Affiliation, estimates that unregulated operators at the moment make up a few fifth of the market. With the price of establishing only one recycling processing line working to round $15 million, it’s simple to see why bit gamers have sprung up. Their presence threatens to undermine the credibility of China’s recycled batteries as a result of they don’t at all times adhere to environmental and security requirements. And since they don’t must spend money on these correct protections, they’ll provide EV and different battery house owners larger costs, diverting useful cells to a much less fascinating provide chain.

“When you enable extra of those small workshops to exist, the sources will stream to wherever they’ll generate the best return,” says Zhang Yuping, deputy normal supervisor of one of many nation’s largest recycling corporations GEM Co. “It’s identical to medicine.”

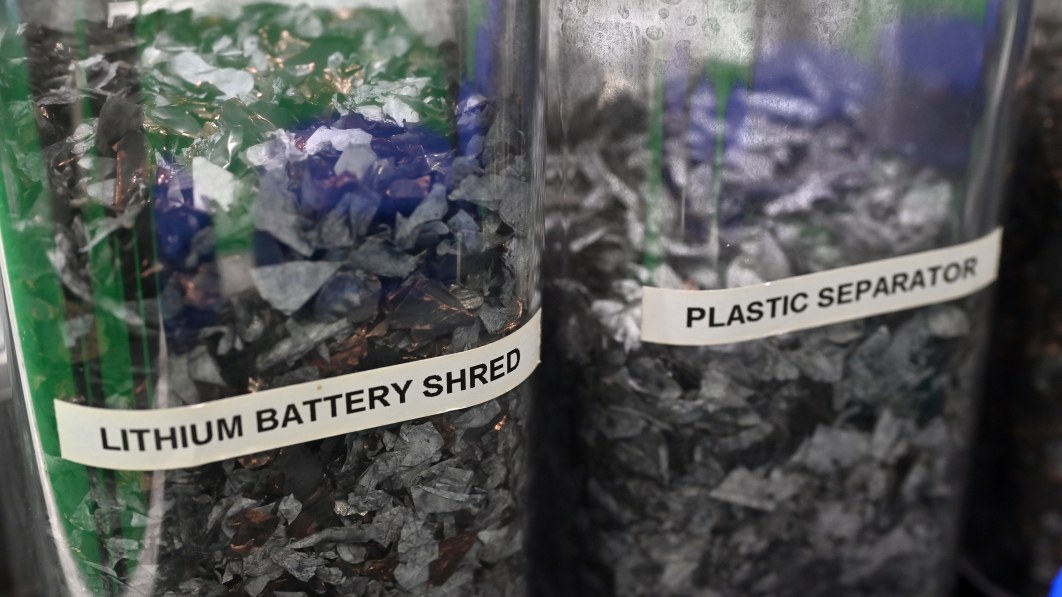

Essentially the most worthwhile EV batteries to recycle are product of lithium, nickel, cobalt and manganese. To extract the metals, the batteries must be dismantled and shredded into what’s generally known as “black mass,” which is then dissolved in highly effective chemical substances.

It’s that first step that’s sparked a cottage business of small-time recyclers in locations like Tangxia, a city close to the southern Chinese language metropolis of Dongguan. Xu Wei, one battery dealer Bloomberg spoke to there, stated enterprise was thriving till the native authorities cracked down following a collection of unintended fires.

Pan Juntian, a reporter at an area media outlet, spent two weeks undercover to get a glance inside these workshops. “With out superior equipment, the dissembling of battery packs requires an enormous quantity of labor,” he stated. Staff paid by the hour, with simply material masks for cover, used wrecking bars and electrical saws to pry open the containers. They have been “all male, and it took them a minimum of one hour to open up a battery pack.”

The situations are a far cry from GEM’s state-of-the-art analysis and growth facility in Wuhan. Cameras outfitted with thermal sensors monitor for potential fires as employees use forklifts — powered by recycled batteries — to kind and transport used batteries into warehouses. Particular cupboards assist to regulate the voltage and present to forestall explosions in the course of the preliminary processing phases.

At one other GEM facility that Bloomberg visited in Jingmen, a multi-story system of conveyor belts, pipes, furnaces and crushers exemplifies the semi-automated processes adopted by main gamers in China. Staff in grey jumpers and laborious hats wore heavy-duty industrial masks to guard their lungs from the mud.

GEM, which says it processes round 10% of China’s retired EV batteries, quadrupled its recycling income final 12 months from 2021. It additionally earned a spot on the federal government’s so-called whitelist of 156 key business gamers, which grants corporations precedence standing when bidding for key authorities and state-owned enterprise tasks. Gaining entry requires passing rigorous evaluations that cowl operations in addition to environmental and technological requirements.

None of that applies to the grey market fueled by merchants like Li and workshops like those in Dongguan. It’s an enormous security danger as a result of they’re coping with issues they don’t totally perceive, stated an analyst at a commodity-pricing agency, who requested to not be named discussing unofficial actions.

Transportation is one other drawback. Beneath China’s nationwide commonplace, vehicles carrying outdated batteries have to be outfitted with smoke alarms in addition to flame retardant and heat-insulating packaging. However many unofficial gamers both don’t wish to pay the price, or don’t have the sources.As a substitute of utilizing specialised autos, some flip to Huolala, an on-demand trucking service supplier, stated Yu Haijun, vp of Guangdong Brunp Recycling Expertise Co., a subsidiary of Chinese language battery big CATL. “The transport from level A to level B might price 40,000 yuan or 4,000 yuan. The distinction is large.”

The Chinese language authorities has been making an attempt to control the quick-growing market.

An overarching coverage framework is in place to supply tips concerning the tasks of the varied gamers. There are nationwide requirements on battery specs and across the dismantling of cells and their remaining power-testing necessities. Beijing can be pushing for a country-wide platform to trace the lifecycles of batteries.

However business watchers say the measures at the moment lack enforcement energy.

The federal government directs automakers and others to work with recyclers on the whitelist, “however technically that is not obligatory proper now,” stated Yang Qingyu, a senior advisor with the China Battery Cooperation Union, a nonprofit group that features greater than 2,000 corporations.

Because of this, and within the absence of extreme penalties, the truth is that many retired batteries nonetheless stream into gray-market channels. Stricter guidelines that inflict punishment on non-compliant gamers are wanted with a view to foster a more healthy market. GEM’s Zhang, for instance, says the whitelist ought to grow to be “not solely a suggestion checklist or a precedence checklist, however an actual entry qualification” by 2025.

Cleansing up its recycling act even additional would assist China cement its world-leading place within the EV market. Automakers would decrease prices in the event that they recycled the batteries of their automobiles, says Hu Feng, vp of the Shenzhen-based GaoGong Lithium Battery Analysis Middle. Over time, they might construct a steady provide of core supplies.

Its ESG credentials could be burnished additionally. The carbon footprint of recycled EV supplies is decrease than from conventional mines. Within the case of a nickel-rich battery in Europe utilizing the hydrometallurgical technique, for instance, the carbon footprint may very well be 4 to 5 instances much less, based on McKinsey & Co.

Each gram counts when costs of electric-car uncooked supplies have surged to historic highs over the previous 12 months. China nonetheless depends on abroad imports for greater than 90% of its cobalt and nickel sources, and greater than half of its lithium. Business tips dictate that every recycled battery ought to yield a minimum of 98% of its authentic cobalt and nickel content material, and 85% of its lithium. Massive recyclers haven’t any points reaching the thresholds, however smaller gamers can wrestle.

They “prioritize high-value recoverables,” stated Mina Ha, an analyst at battery consultancy Rho Movement. “Every thing else finally ends up as waste.”

Getting the system working proper would additionally assist Chinese language automakers higher market their automobiles abroad. The EU has set necessary minimal ranges of recycled content material in electrical automobiles offered there, initially at 16% for cobalt, 85% for lead, 6% for lithium and 6% for nickel. There’s additionally the duty to arrange an digital ‘battery passport’ and a QR code by 2027 to confirm the supply of uncooked supplies, together with separate lithium assortment targets for waste batteries.

“Chinese language carmakers have entry to each a bigger and extra mature recycling market, and so they’re producing autos in a market that doesn’t have the identical necessities because the EU,” stated Hans Eric Melin, managing director at Round Power Storage. Meaning Chinese language producers can direct batteries with recycled content material to automobiles for export to Europe, he stated.

China’s “major benefit lies in its robust place in battery materials manufacturing, of which recycling is an built-in course of,” Melin stated. “That’s what we have not actually bought our head round within the West.”

[ad_2]

Supply hyperlink

Leave a Reply